Fleet and Business

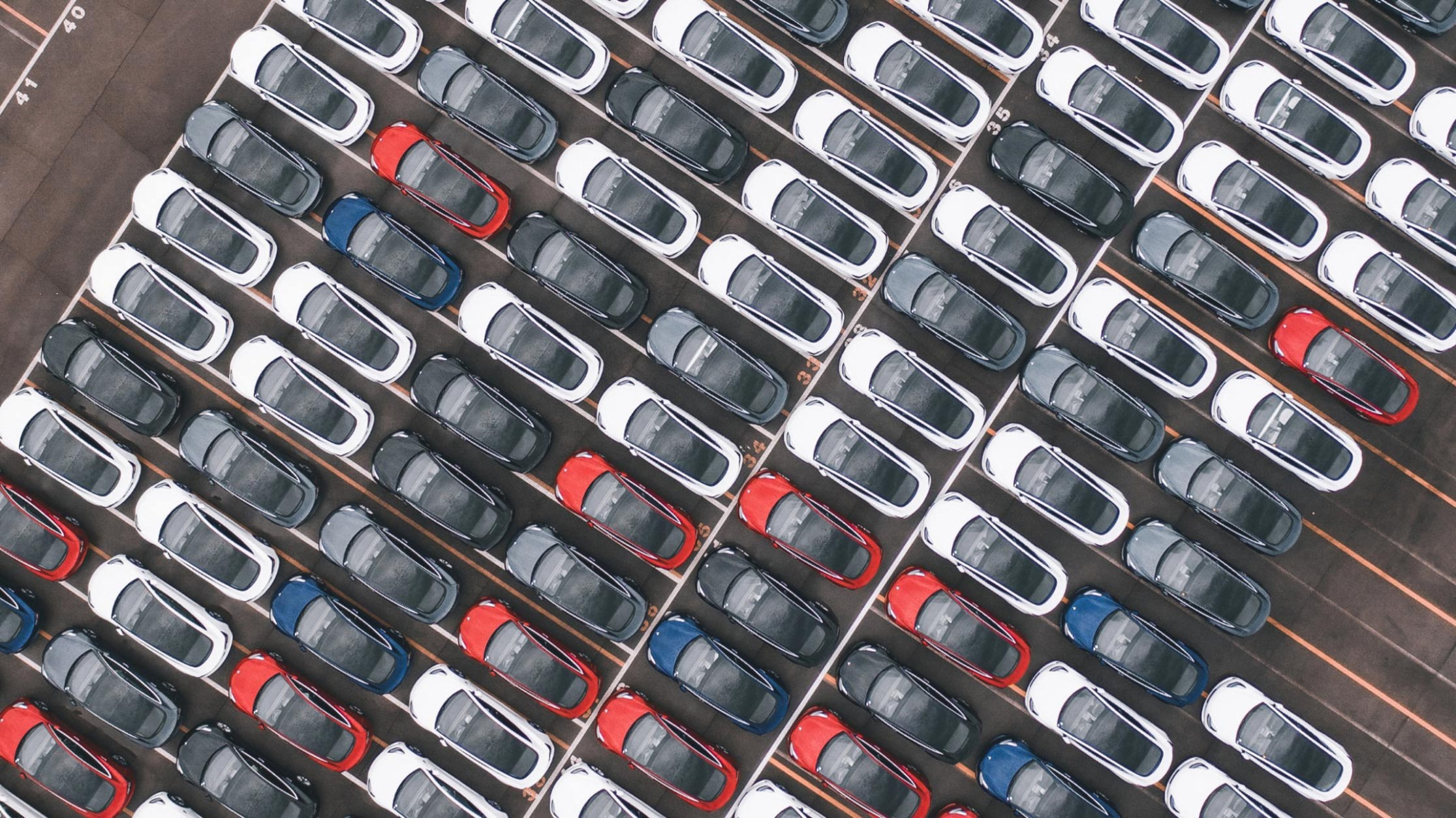

Emission-Free Fleet

Emission-Free Fleet

World's Largest Fast Charging Network

World's Largest Fast Charging Network

Over-The-Air Software Updates

Over-The-Air Software Updates

Cost of Ownership

-

Drive sustainability: zero emission

-

Viable fuel-saving cost

-

Minimal vehicle maintenance cost

-

Low license fee

Tesla Vehicle Benefits

-

Thorough charging support

-

Access to largest fast charging network in Hong Kong

-

Over-the-air software updates

-

Remote access with the Tesla app

-

Remote diagnostics and Mobile Service

EV Incentives

-

First Registration Tax (FRT) Concessions for Electric Private Cars (e-PCs)

FRT for e-PCs will be waived up to $97,500 from 1 April 2018 to 31 March 2024. -

“One-for-One Replacement” Scheme

A "One-for-One Replacement" Scheme will be launched from 28 February 2018 to 31 March 2024, allowing PC owners who arrange to scrap and de-register their own eligible old PC ("Old PC") (PC with an internal combustion engine or e-PC) and then first register a new e-PC ("Replacement e-PC") to enjoy a higher FRT concession up to $287,500. -

Profits Tax Deduction for Capital Expenditure on Environment-friendly Vehicles

Starting from 18 June 2010, businesses which have purchased eligible environment-friendly vehicles may deduct the capital expenditure incurred under profits tax. The new tax concession is applicable in the year of assessment 2010/11 and thereafter.

Contact Us

Tesla Enterprise team will reach out to learn more about your fleet needs. To learn more, contact us at CorporateHK@tesla.com.